TISA: Educating Member Employees Of Responsible Savings And Sustainable Borrowing

Sep. 24, 2019, 01:09 pm.

Teachers Savings and Loan Society Limited ‘TISA’ established in 1972 is the Credit Union for Teachers and Government employees. TISA is the largest Credit Union in Papua New Guinea and the Pacific, with investments in banking, insurance and properties.

With branch office presence in 17 regional centers around the country, TISA provides an avenue for registered teachers, employees of Government departments, State Authorities and State Owned Entities to be actively involved in savings and to assist with affordable loan products. With the new Savings and Loan Act 2015, TISA is looking to expand its market to include the private sector and other business houses in the near future.

As stated in our vision statement, the Society stands “Not for Profit, Not for Charity, But for Service” and in the last few years TISA has put in the efforts to remain true to its vision and mission statement to review and promote polices that address the financial burdens of its members while educating them in responsible savings and sustainable borrowing behavior.

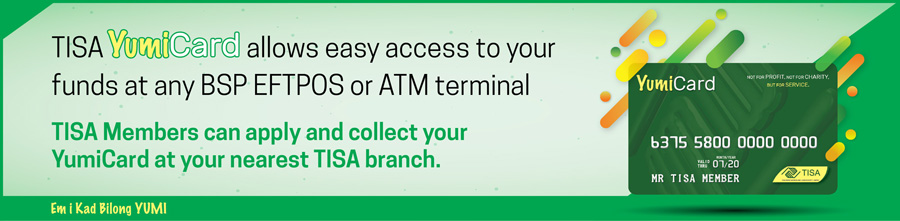

Embracing the digital era, TISA is progressively utilizing electronic channels to reach our members being the first Savings and Loan society to offer its members the YUMI debt card for members’ easy access to funds. TISA continues to work towards assisting its members access our service with ease and convenience through e-channels for self-serve, supported by our 24/7 helpdesk to consult our talented team when queries arise.

TISA has the mandate to be custodians of our members’ funds and therefore trust from our members and the wider community is of paramount importance to us. Our stringent check and balance policies with guided system provides, and in cases, demands service that reflects quality assurance, relevance, growth, sustainability and overall sense of accountability from us to our members and the wider community.

PRODUCTS

TISA YUMI ACCOUNT

TISA recently in May 2019 introduced to marketing YUMI Account, a transaction account for day-to-day use. The YUMI Card is now linked to this YUMI Account and not to members General Savings Account.

TISA SAVINGS PRODUCTS

The prominent benefit for TISA’S Savings products are the generous interest rates on Savings. The General Savings attracts a 2% percent interest per annum while the generic and special purpose savings account earns a fair 6% percent per annum on members’ savings.

TISA LOAN PRODUCTS

Personal Loans

TISA personal loans are flexibly designed to assist caters for our members financial needs | Minimum loan amount of K200 to maximum of K100, 000 | Affordable interest rate | Term of loan depends on the purpose of the loan

Refinancing Loan

TISA offers loan refinancing to assist members roll ALL loan with other financial institutions and or commercial banks into just one (1) loan with TISA | Offers relief for members to have MORE take home pay

TISA E-CHANNEL SERVICES

Internet Banking

TISA’s internet banking service provides members easy viewing of their account balances and a cost efficient access to their account statements

SMS Account Check

Available to members to access savings and loan balance, interest paid and recent transactions on your TISA accounts | Simple register your mobile number for this SMS balance check service

YUMI Debt card

YUMICard is TISA’s debt card product linked to the YUMI transaction Account | Members can have access to their funds using the YUMICard on any BSP ATM or EFTPOS terminal nationwide.

English

English  Tok Pisin

Tok Pisin  简体中文

简体中文